The Quantum Group of Funds is one of the most successful hedge funds in history. Built by uberinvestor George Soros, it was only recently overtaken by Bridgewater Associates according to Institutional Investor.

While he has since retired and transformed his firm into a privately-run family office, there is a tremendous amount that active investors can learn from him.

Given its huge success since its inception, I thought a study into the growth and history of Soros’ firm would be interesting. While there are many posts and books out there on the man himself, I will concentrate on the (a) investment philosophy & mindset, (b) strategies and (c) management of the Quantum Fund, using various sources of information as well as several case studies to provide insights and takeaways for all of us. This post will be the first piece of 3 articles, and it will concentrate on Quantum’s investment philosophy and mindset.

Professor Aswath Damodaran from NYU mentioned that an investment philosophy is ” coherent way of thinking about markets, how they work (and sometimes do not), and the types of mistakes that you believe consistently underlie investor behaviour.” Damodaran also mentioned that the ingredients of an investment philosophy includes one’s beliefs of human frailty, market efficiency and the developing of strategies and tactics. As we shall see, Soros’ beliefs of the human condition, the nature of the world and global financial markets is consistently thorough and has allowed him to develop a ruthless money-making investment firm over the years.

(I) Uncertainty is the rule of the game!

Was there once when you were so ‘doubly-sure’ on something, but it turned out that you were utterly wrong? Were you surprised and shocked? Were you frustrated that despite all that hard work and effort that you’ve put in, your opinion was totally and completely redundant as the truth or reality unfolded?

Well, Soros wouldn’t care at all if he was wrong on anything. Why? He believes that human beings are fallible creatures, with imperfect understanding of the environment around us. Simply put, we are imperfect beings operating within an imperfect world. Once you accept your own fallibility, it does not matter anymore if you get things wrong (or even if you get something right!). This gives you the courage to become impersonal about your own opinions.

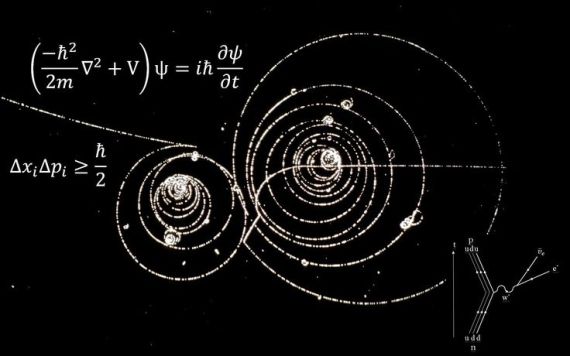

He was intrigued by a concept from Quantum Mechanics, the Heisenberg Uncertainty Principle, which postulates that the precise position and momentum of a particle X cannot be accurately measured at the same time (see Khan Academy’s explanation). Here’s the formula:

No matter how sure you are on something, there is still an element of uncertainty out there. This is similar to the concept of acknowledging that there are ‘unknown unknowns’. This understanding is crucial, as it gives you the courage and conviction to (i) admit that you can be wrong, (ii) acknowledge the markets could be wrong, (iii) accept that both you and the markets could be wrong in variant degrees. This understanding also allows you to develop contingent plans and courses of actions to work on uncertainty and to deal with mistakes. “It is perfectly alright if you do not know what will happen, what matters is how you respond”.

Soros believes that the global financial markets is one such area where imperfect beings are operating within an imperfect environment. He believes that the markets cannot be understood merely by what traditional economics tells us and solely by financial concepts. The financial markets are not efficient (at least not in the academic sense of strongly efficient), and there is no point in debating or discussing about it. There is nothing real and tangible in the markets, except save for a mixed bunch of opinions and belief systems out there. In order to survive and make money in the markets, we need to think in possibilities, and constantly adapt to an ever-changing paradigm.

(II) Taking on risk inevitable: manage it!

In order to generate investment returns, one has to adopt some level of risk. This is a widely-held belief not just in the global investment community but also among the general public. While it is certainly true in essence, there could also be a misconception of the understanding of what risk is. Most people believe that risk is two-dimensional in that in order to have higher potential returns, one has to assume a higher level of risk commensurately. This is represented by this familiar chart:

However, Soros sees it differently. Firstly, he thinks that everything has an element of risk that is both knowable and unknowable (uncertainty principle). This stands in huge contrast with what the average investor believes, even among many professional investors. A ‘risk-free’ asset could turn out to be disastrous in an extreme and unexpected circumstance – Soros would prefer to deem what people call a ‘risk-free’ asset as ‘low risk based on what I or others know’. Notice the difference? It may be subtle but it’s a drastic change in mindset.

Secondly, he believes that one does not necessarily need to take on more risk in order to produce higher returns. Soros is obsessed with using as little resources (risking little) as possible to make as much as possible, thus he constantly looks for positive asymmetric opportunities that is worth the risks involved.

Thirdly, because Soros believes that everything has an element of risk that is both knowable and unknowable, he is comfortable to press his advantage and take on various degree of risks when necessary. In various biographies, it’s mentioned that Soros described his time as a refugee during the Second World War as the ‘best time of his life’. He was comfortable ‘living riskily’ when he was a youth, and when he was running and managing Quantum in his later years, ex-employees revealed that Soros certainly knew how to dispassionately exploit advantages like a riverboat gambler as well as cut back and ‘de-risk’ when the time calls for it – literally akin to a refugee surviving through a hostile environment void of resources.

The crucial point here is that Soros is perfectly alright with taking on risk as long as he understands the source and the nature of what he is dealing with. And because risk is entirely subjective, what Soros does at times could indeed come off as highly risky in the eyes of an outsider or spectator.

In order to play the game, one has to endure the pain. You just need to prepare and manage it.

(III) The Bottom Line is all that matters!

Because of what he believes in the above portion under the Uncertainty Principle, Soros has built his investment firm to ruthlessly focus on profits. Nothing else matters, period. In fact, in a mandarin book on the man himself (向索罗斯学投资), it was mentioned that when Soros tried to recall his investment activity, he could not find a proper system or rules, but rather he found constantly changing patterns that were unforeseeable beforehand. Any new form of speculation had a different condition than the prior, encountering different variant circumstances. As quoted in Drobny’s “Inside the House of Money” and in “Soros on Soros”, Soros stated that:

“I don’t play the game by a particular set of rules; I look for changes in the rules of the game.”

The Quantum Fund was unique in that it had not set trading or investment strategy. This may seem bizarre back then and even by today’s standards. The existence of a bunch of different biases, belief systems and opinions in the markets that are possibly misinformed and false provides a ton of opportunities to exploit and monetise. Soros believes that having a set investment strategy is merely an ego-building exercise that could turn one myopic; afterall, you’re in the markets to make money. The Quantum Fund was highly opportunistic, investing across all asset classes, across the world, and had no directional bias, playing both the long and short sides of markets.

Soros also had no qualms in riding bubbles and manias, or going against the crowd when he thinks its appropriate. He once mentioned that when he sees a bubble forming, he rushes in to buy, “adding the fuel to the fire.” He also famously crusaded against various central banks in the decade of the 1990s, betting big and capitalising on the collapses of currency pegs in Europe’s foreign exchange markets and across emerging markets.

This unconstrained and ruthless approach on focusing on profits was seen throughout the growth of Soros’ firm, starting in the 1970s as a hedge fund startup speculating in various financial assets all the way into its closure at the turn of the century and its evolution into a family office that consists of real assets, private equity and venture capital vehicles. The Quantum Fund literally adapted and evolved throughout the years.

This shrewd focus on profits and a ‘zero ego’ approach also had the consequence of allowing Soros to deal quickly with losses and investments that do not work out!

Now that we know what Soros’ philosophy and mindset is, the next post will cover this swashbuckling firm’s investment strategy! Stay tuned!

*image credits to http://cdn.quotesgram.com & https://sciencefiles.files.wordpress.com/*

4 thoughts on “Lessons from Soros’ Quantum Fund! Part I”