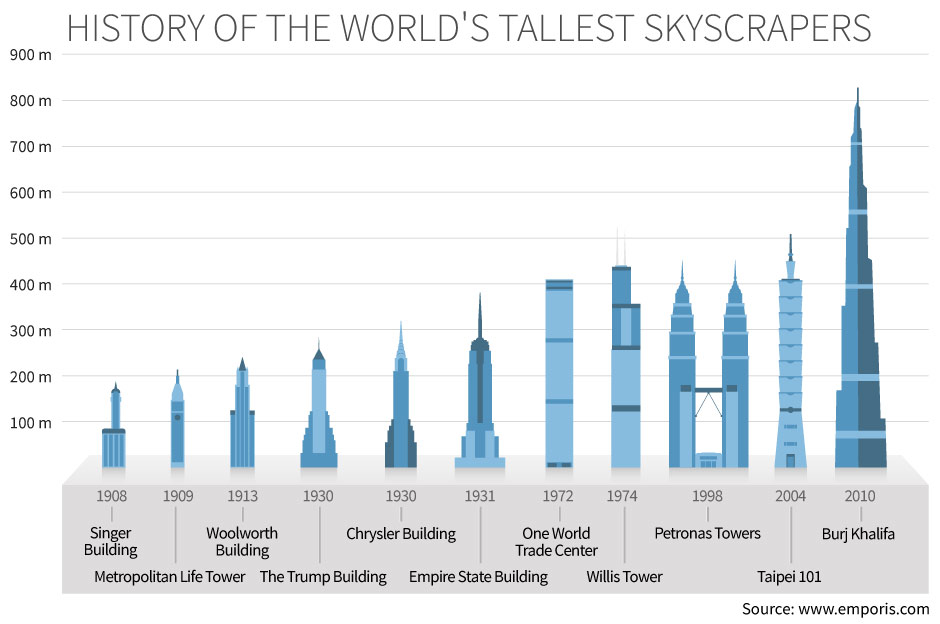

Take a look at this info-graphic for a moment:

It chronicles the history of the tallest skyscrapers ever built on earth. Now, look at the years they were completed. Notice anything interesting? Here’s a hint: historically, each new skyscraper coincided with the end of an economic boom associated with it… a hallmark that signifies the end of an era. The completion of the Chrysler Building and the Empire State Building both coincided with the end of the 1920s boom in the US, signifying the start of the infamous Great Depression of the 1930s. The Petronas Towers in Kuala Lumpur was completed after the Asian Financial Crisis of 1997 broke out, after many Asian economies experienced a period of strong GDP growth rates and a financial boom…

This is what The Economist calls the “Skyscraper Effect” (for more information about it, the Mises Institute has some interesting thoughts).

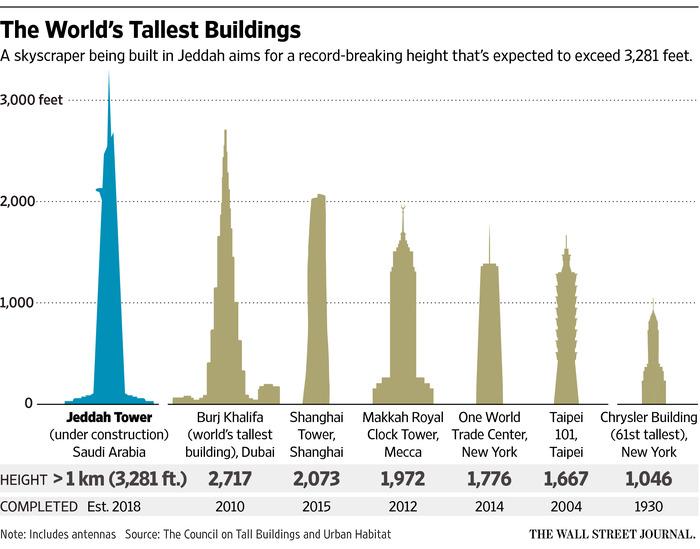

Would the Jeddah Tower once again mark the end of a cycle? Or is the skyscraper effect just plainly a mere coincidence? Too some however, the skyscraper effect makes economic sense. Historically, the development projects were drawn up during a period of prosperity, in times of great optimism. The actual construction takes a long period of time to play out before its final completion. By the time the new development is completed, the “boom” and all the accompanying euphoria has evaporated.

Now with the above being mentioned, let’s turn our attention back to the current state of affairs.

Over in the global energy market, the situation looks dismal at best.

OPEC’s strategy of crushing the oil cowboys in America’s Midwest have failed. US crude oil production have remained surprisingly resilient according to the DOE & IEA’s data. The Bank of International Settlements (BIS) have actually reported last year that the entire industry has been fueled by cheap credit, with producers continuing production in order to service their debt obligations and to keep their credit taps flowing in order to stay in business – this is something which the Saudis probably overlooked.

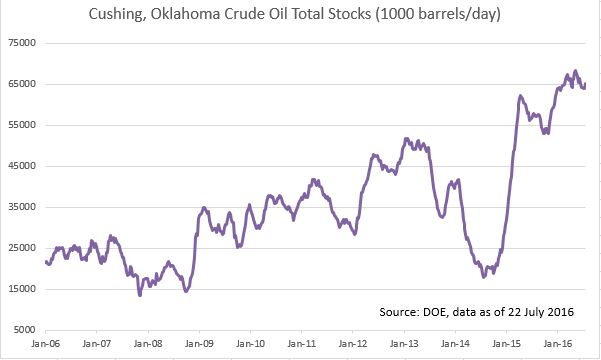

Simultaneously, inventories are at historic highs.

A quick look at oil stocks at Cushing, Oklahoma in the US as well as the IEA’s data of oil inventories in OECD countries reveals that there’s a ton of crude oil in storage. Moreover, the IEA’s July 2016 report indicated that floating storage are at 7-year highs! All this excess supply needs time to be worked through, and they present a huge headache for anyone hoping for a strong lasting rebound in crude oil prices (excess inventories could be dumped onto the market anytime prices recover).

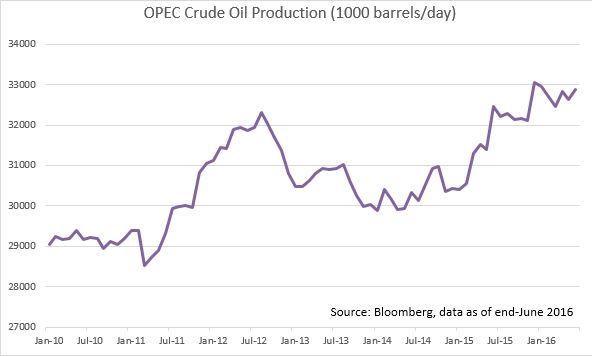

OPEC has also ran the taps continuously:

Additionally, OPEC seems to have lost its relevance as a cartel given that Iran has re-entered the global community. Both the Iranians and the Saudis are geopolitical rivals in the Middle East, and the Saudis are adamant in ensuring that they maintain their market share of oil exports and that the Iranians do not capture too much. This is a recipe for a race to the bottom, and disunity among OPEC members don’t really bode well for maintenance of supply quotas…

On the demand side, there’s terrible news for long-term oil bulls.

Over the past 15 years of rising crude oil prices, the world (at least in the West) have adapted to high prices and gotten more energy-efficient. Renewables have also become very cost-efficient, and there’s a ton of information out there suggesting that in the next decade (by 2025), renewable energy (like wind, solar, nuclear) as well as its related technologies would be widely utilised in governments’ energy mixes worldwide. The IEA has some interesting data here on how renewables have been steadily increasing their market share over the past few years.

Additionally, China, a key oil importer, is rebalancing its economy to a consumer and services-orientated model and at the same lowering its reliance on fossil fuels. This is an important piece of the jigsaw, and Chinese policy-makers have pumped resources into renewables and alternative energy sources in their attempt to clean up the mess of a legacy of an industrial past that was heavily driven by coal and crude oil.

Have we reached peak demand?

Under the veil of Saudi Arabia:

Saudi Arabia knows this. They are after all the biggest player of the black gold game, and it may be wise to assume that they actually feel that there is peak demand for crude oil going forward given the reasons above – this can be seen in their actions and intentions.

Since late 2014, the Saudis have embarked on the following:

- they have set up a whopping US$ 2 trillion investment fund in an attempt to diversify their economy away from hydrocarbons and to generate alternative revenue streams over the next 5 – 10 years

- they have fiscal adjustments – cutting expenditures in latest budget adjustments, and tapping the debt markets for a portion of their financing requirements. Via Bloomberg: “the country’s ratio of debt to economic output, the world’s lowest in 2014, is expected to increase to over 25% by 2017, according to the International Monetary Fund, which said in October that the kingdom risked wiping out its financial reserves in 5 years”

- they have even decided to overhaul their military in the process! (this is despite their ongoing military operation in Yemen)

This tells us that the world’s largest player seems to be preparing and hunkering down for a prolonged period of low oil prices. The NTP and many initiatives are designed to structurally reform and modernise the economy. Doesn’t this send a troubling signal to anyone who is optimistic that crude oil prices would recover substantially higher and stay higher?

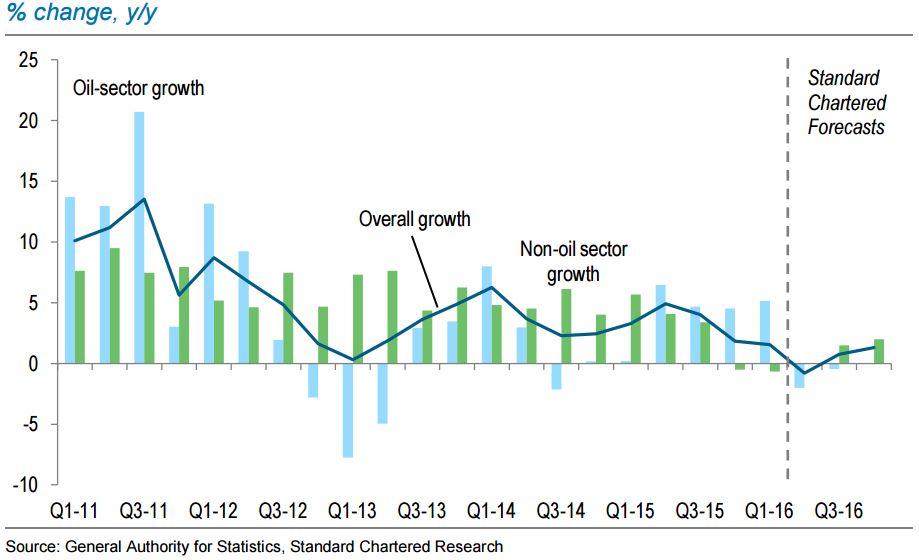

Moreover, economic data coming out from the kingdom suggests that momentum is slowing and that the kingdom is struggling to rebalance its economy away from fossil fuels. According to Standard Chartered, non-oil sector growth has been sluggish since 2014, and the current fiscal consolidation is weighing heavily on overall economic growth.

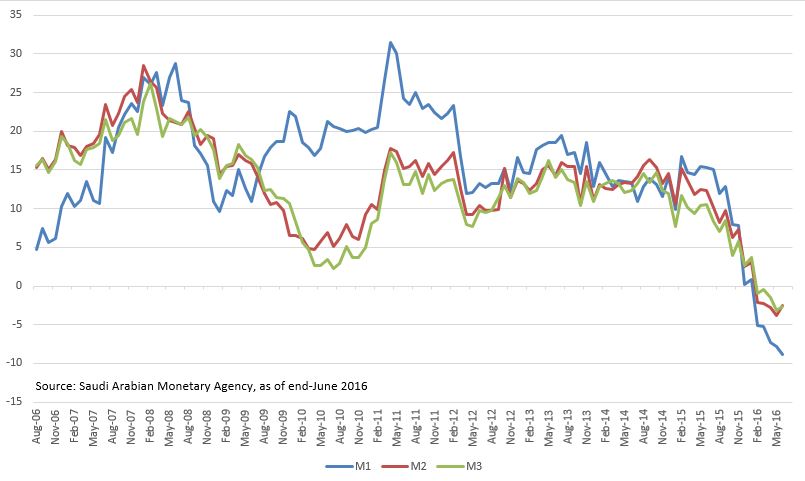

Monetary aggregates seem to confirm the current trend, as shown in the deceleration of M2 growth on a year-on-year basis that started since the second half of 2016:

With diversification (from energy sector) slow and a steadily declining revenue base from crude oil’s bleak future, the Saudis are facing an existential crisis on the horizon. Fiscal austerity also may complicate efforts to placate a complacent and spoiled populace. It remains to be seen if they can pull this off…

With diversification (from energy sector) slow and a steadily declining revenue base from crude oil’s bleak future, the Saudis are facing an existential crisis on the horizon. Fiscal austerity also may complicate efforts to placate a complacent and spoiled populace. It remains to be seen if they can pull this off…

Now, back to our Jeddah Tower that I mentioned at the beginning: Would that skyscraper go down in history marking the end of a Saudi golden age – a tombstone of a hydrocarbon juggernaut?

Suggested course of action?

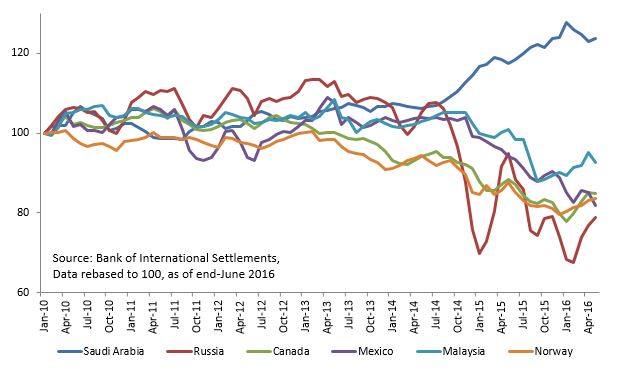

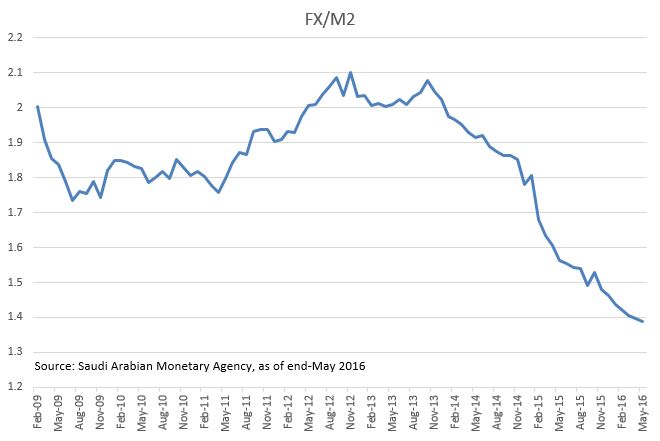

Hedge fund manager Zachary Schreiber, who made a killing betting against crude oil in 2014, has openly mentioned that he is shorting the Saudi Arabian currency (the Riyal). The spot Saudi Riyal (SAR) is pegged to the USD (3.75) at this current juncture. The Saudi government seems to be sensitive to this, with news about regulators banning products that allow speculators to bet against the 3-decade-old dollar peg. Looking at the spread between onshore and offshore SAR rates a là Bloomberg, there are expectations for a weakening of the Riyal.

*cover image taken from www.gizmodo.com.au *

Great post on relationship between Saudi’s economy / monetary policy and oil ,,, and interesting observation on skyscraper effect !!! Guess if oil price remain low for few more years ,,it will definitely give more pressure to Saudi on their fiscal policy and also maintains their peg on Riyal..yah,,, only time will tell… Cheers

LikeLike