Articles I’m reading

Zichen Wang of Pekingnology shared about China’s Third Plenum – that Beijing may have finally come around to stimulating domestic consumption rather than investment. Zichen wrote that David Daokui Li, Director of Tsinghua University’s Academic Center for Chinese Economic Practice and Thinking, emphasised in a recent luncheon that the central government will be rolling out major policy reforms aimed to boost welfare and income.

This will come in three aspects: (i) reducing restrictions on house purchases across cities, (ii) providing direct financial support for the headquarters of developers, and (iii) tweaking the incentives of local governments from production to consumption. Zichen shared some objections and responses of various participants in his piece, which may include some thoughts of what you may have too if you’re investing in China. Here’s an excerpt:

Ted Plafker, another veteran China correspondent of The Economist, really wanted to get to the bottom: Everyone’s agreed it should be done and it just hasn’t been done for all these years. There are obstacles. As you said, policy makers are rational. There are good reasons why things do or don’t happen. So I wonder now if you have more confidence that it might happen now. And if so, why has it not happened all these years and what is different that will allow it to happen now?

Professor Li, your recommendation that there be a shift away from production and towards more consumption and you seem confident that at the Third Plenum may be this. I’ve been hearing it for a very, very long time. I remember in 1998, it must have been, Premier Zhu Rongji was at his press conference and he said something like 刺激内需 [stimulate internal demand] and I had to look up 内需 in my dictionary — internal demand. Stephen Roach has been coming here for years and years, saying we have to rebalance, less fixed asset investment, more consumption, encouraging consumption.

David Daokui Li answered

My brief answer is this: when you talk about internal demand over the years since Zhu Rongji 内需. Usually, policy makers refer to domestic investment because in China, 内需 is domestic investment plus domestic consumption, relative to exporting.

But to answer the question why policy makers have not been forthcoming with the policies that you allude to — basic social welfare provision, public housing, so on and so forth, there’s one fundamental belief which is now changing. That is, if the government provides too much social welfare, the population will become lazy. I’ll put it in brutal language. I’m sorry, it’s not diplomatic. We should avoid getting into the problem of the British disease. I’m sorry for people from Britain. In economics, we call it British disease…The British disease is that the government provides too much social welfare, therefore people don’t look look for jobs.

So China, somewhere, somehow or the past 40 years, when the incumbent policy makers were getting their college education like myself, we were educated by what we call Western economics, which talk about the British disease. This is the Mrs. Thatcher and the Reagan era. So our mentality is framed by that. We’re supposed to say, okay, the government should work hard on the supply side; don’t worry about demand side; too much social welfare will kill the enthusiasm of the population for working hard.

So I think we were wrong. At least we were pushing too hard in this direction. The Chinese people, in my view, are genetically — I hope you agree, Mr. Wang Xing — genetically programmed to work too hard. We should relax. I’m criticizing myself. I’m not criticizing anybody else. I can make jokes on our people, right? I’m not politically incorrect. So we’re not relaxed enough. So much so that the little bit extra welfare programs for us, for our population, will not make us lazy. We won’t become lazy.

I think my friends in the policy making community are coming to this realization. They’re coming to this. So I really felt excited when I watched Chinese 7 p.m. Evening News on CCTV where President Xi said, okay, let’s do reforms to make sure the population can really feel it. I’m excited. I’m confident he refers to this. Next stage, we need reforms to provide more welfare.

Let just give one example to make things concrete. When young ladies deliver a baby, you know what is the most difficult thing for Chinese families? Take care of her in the first month. We have a tradition that the first month after a baby’s birth, the most important thing is her life. So tremendous energy is spent in the first month we call 坐月子, the first month’s care. Now many families are worried about this okay anticipating the huge cost of the first-month-of-the-baby caring. They wouldn’t want the second baby or not even the first baby. So I’ve been proposing that why not give 10,000 RMB to any family having a new baby to take the first one month (care)? Not a big deal…If you calculate it, it’s a small amount of money in public finance. So I think my proposal is gaining popularity. We’ll do that. We can do that. There are lots of interesting things we can do.

Also, from age 3 to age 6, preschool education should be free for everybody. Our population is not growing as fast as before. So there are many, many reforms which are not expensive from the public finance perspective, which will be popular, and which will relieve people of the burden of daily life so they can consume more. I think this is a win-win. Things are slow but I’m confident. They are coming. They are coming along.

Still on China, the State Council has released an action plan for energy conservation and carbon reduction for 2024-2025, aiming to reduce energy consumption and CO2 emissions per unit of GDP by approximately 2.5% and 3.9% respectively in 2024. The Chinese have been working hard on cleaning up their country and are now leaders in renewable energy infrastructure. I love this and this also will mean more investment in strategic minerals (like copper, tin, which I’m bullish on) for their green economy.

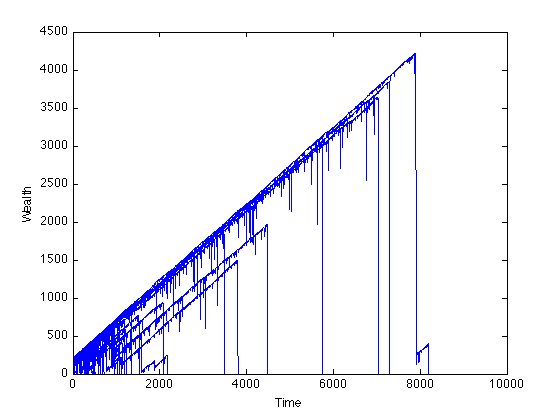

I found this old post on StackExchange (math-lovers and quants will love this site) about the Martingale system. For the unenlightened, the Martingale betting system is a strategy that consists of doubling down on a losing bet and continuing to double down everytime the gambler experiences a loss.

A question was raised in the post: “If you keep doubling, it is true that you might encounter catastrophic losses, but the probability that you get 5 heads in a row is 1/32, quite low, and it decreases to zero exponentially. Thus, to me it seems that it should be rare , assuming that the probability of head is .5, to have to play more than 6/7 rounds in real life.”

A respondent ran a simulation to illustrate the drawbacks of the Martingale system, that despite the low probability of having five heads in a row, it is still nonzero and it will eventually happen, which would mean a catastrophic loss for the gambler:

“As you can see, there are only 9 players who make it past 2,000 time steps, only 5 who make it past 4,000 and only 3 who make it past 6,000. By timestep 10,000 everyone has gone broke. “In the long run, we’re all dead. It’s a common psychological bias to discount low-probability events when making decisions (even when you know about the effect!) which is why the martingale strategy seems like such a good deal on first examination.“

Keep this in mind when managing risk in markets… which brings me to this interesting article that the scientific journal Nautilus posted last year.

After the Second World War, a team of researchers led by Austrian Psychologist Else Frenkel-Brunswik set out to uncover the unique psychological traits at the root of authoritarianism and prejudice. There were a range of tests conducted by them, but one particular one known as the cat-dog experiment stood out.

Participants were shown a series of drawings of an animal that at first distinctly resembled a cat but then, bit by bit, with a tweak to an ear or a broadening of a muzzle, turned fully canine. The middle pictures were indeterminate, and for some, that proved unnerving. Again and again, these participants refused to surrender the safe harbor of their first answer until the sequence was nearly complete. They showed “a preference to escape into whatever seems definite,” wrote the researcher Else Frenkel-Brunswik.

What’s interesting is that the researchers found that the participants were very reluctant to change from their first answer until the very end of the deck, well after the point where the sketch began to resemble a dog. They were very agitated while going through the middle of the stack, as if unnerved being forced into mental contortions to justify their initial response. Else noted that: “they showed a preference to escape into whatever seems definite“.

The intolerance of uncertainty, the preference to escape into whatever that seems definite, are human traits that we all possess. In markets, that translates to being too stubborn on views when they are no longer valid. The graveyards of Wall Street are filled with stories of investors not recognising that they’re wrong.

A Podcast to listen

This is a podcast from 2022, where CEO of Algebris Investments, Davide Serra was interviewed by FT in London. Serra shared how to succeed in the world of finance, and here’s some of the takeaways:

- Three rules in investing: number one: don’t lose money. number two: don’t lose money. number three: don’t lose money

- Understand what’s happening around the world: “What are the rules of engagement in which society operates. Geopolitics and the democracy in the western world, as the autocracy in most parts of the world, do matter because these are the rules under which then you can operate as a citizen and as a business… it’s very important for young students to follow them. In my early days, back then, I remember in Bocconi, I started reading The Economist and then the FT.“

- Read history to understand how black swans always happen – “Look at the data, act swiftly and having read history, every 100 years a pandemic is always struck. By the way after a pandemic always had massive inflation and war and so you just had to read it to be prepared for it“

- Do your homework before forming an opinion: “Do your numbers, do your math, then open your mouth. That’s why for example, I call Algebris from Algebra, plus, minus, divide and multiply. Any statement you make must be backed by hard facts and numbers because you can’t make an opinion if you don’t have the basic numbers. 99% of people speak without having done before basic math operation and having started how to add up those numbers“

Serra also shared about his thoughts on sustainability investing, education, and entrepreneurship. Take a listen.

Book I’m reading

Consilience: The Unity of Knowledge – Edward O. Wilson

According to the Oxford Dictionary, Consilience means ‘agreement or harmony among two or more disparate scholarly disciplines regarding concepts or underlying principles‘.

Pulitzer Prize winner author Edward O. Wilson published this book back in 1999, where he renewed the search for a unified theory of knowledge in disciplines that range from biology to physics and the humanities.

This is an epic but dense read, where Wilson started from the times of the Enlightenment and its characters such as Newton and Leibniz, and the Marquis de Condorcet. As it progresses, the chemistry of the mind and genetic bases of culture are explored, and biological principles underlying works of art from cave-drawings to Lolita are postulated.

It is well written and thought through, and its breadth will interest inquisitive, scientific and philosophical minds. It’s critical to think beyond disciplines in the age of Artificial Intelligence where generalists will triumph over specialists. People who can think and operate across disciplines will increasingly be in demand. It’s time to be the 21st century’s Renaissance Man.