‘Wealth gained hastily will dwindle, but whoever gathers little by little will increase it’ ~ Proverbs 13:11, ESV

I recently overheard two fresh graduates talking. One suggested starting a business; the other brushed it off, saying her dream was to strike the lottery. I hope she was joking—but I’ve heard similar comments too often to dismiss it.

I’ve never dreamed of winning the lottery—the odds are simply too poor. To me, the skill of building and managing wealth is far more valuable and sustainable than hoping for a lucky windfall. After all, if you don’t know how to manage money, you won’t keep it when it comes.

Still, it’s not hard to see why younger people feel this way. Asset prices have outpaced wages in many countries, and job markets are tougher than ever. That gap breeds frustration and hopelessness, which shows up in social and political trends.

When the path ahead feels blocked, the lottery—or its modern cousins, online gambling, meme stocks, and get-rich-quick schemes—can seem like the only chance to get ahead. Social media magnifies it, fueling envy, greed, and fear when we see others flashing sudden gains.

Underneath it all is the same impatience: a belief that shortcuts are better than slow mastery. And it doesn’t just show up in money—it shapes the way people approach their careers and life too. Whether out of fear of being left behind, or simply chasing the next shiny trend, many adopt a short-term mindset. The old apprenticeship model, where mastery was built patiently over years, feels increasingly rare.

But if the odds are stacked against shortcuts, why not focus on building and creating instead? Why chase long shots when the slow path, though less glamorous, is far more certain?

Buffett’s Secret

Jeff Bezos once asked Warren Buffett a simple question: “Your investment strategy is so straightforward. Why doesn’t everyone just copy you?”

Buffett’s reply was disarming: “Because no one wants to get rich slow.”

That’s the heart of it. Getting rich slowly runs against the grain of today’s culture, where speed and shortcuts are glorified.

Buffett and his long-time partner, Charlie Munger, often compared wealth-building to rolling a snowball. It begins small, gathers momentum, and grows larger with every turn. The trick, Buffett said, is to “find wet snow and a long hill.” In other words: find fertile ground, give yourself time, and keep going.

Patience and persistence—not brilliance or luck—are what keep the snowball rolling.

Build and ‘Fatten’ Your Edge

Instead of chasing money for its own sake, the first step is to explore areas where you can actually create value. That takes time. You don’t stumble into an edge—you discover it slowly, then keep working at it until it becomes hard for others to copy.

The next step is to build and ‘fatten’ your edge.

For a business owner, that edge might be serving a part of the market everyone else ignores. For a trader, it could be spotting patterns or mispricings that most people overlook. For an investor, it might be digging into an industry that others have written off, but where real value still exists.

James Dyson is a great example. He was frustrated with his vacuum cleaner and thought he could make it better. What followed wasn’t a quick success. It took him five years and more than 5,000 prototypes before he was satisfied with his design. Then another seven years before he founded Dyson, and two more before his first vacuum hit the shelves in 1993.

That’s more than a decade of failure, rejection, and refinement before any payoff. But once people experienced the product, competitors couldn’t catch up. Dyson had built and fattened his edge.

If you look at the lives of people like Wang Chuanfu (BYD), Jensen Huang (Nvidia), Bernard Arnault (LVMH), or Dietrich Mateschitz (Red Bull), you’ll see the same thing. They weren’t trying to strike it rich overnight. They were laser-focused on building their edge, slowly, patiently, almost obsessively.

And just as important—they knew when to step back from the noise and focus only on the work that mattered.

Disengage and Focus

The Chandler brothers from New Zealand may be the best investors most people haven’t heard of. And that may be intentional. Apart from a rare interview in Institutional Investor, there’s almost nothing about them on the internet.

They turned a $10 million family fortune into $5 billion in twenty years—about 36% a year compounded.

One of their keys to success was simple: they disengaged from the crowd. Instead of basing themselves in New York or London, they chose Dubai and Singapore, far from the noise of Wall Street and the City.

This distance gave them space to think differently. They weren’t caught up in groupthink, herd behavior, or the short-term pressures that dominate most of the industry. It let them focus on their work, take a longer view, and act boldly when opportunities appeared. That’s how they became some of the sharpest investors in places like Hong Kong, Brazil, Japan, and Russia—often at times when others were running the other way.

Disengaging from the crowd and focusing on your work is how you protect and grow your edge.

Aligning to the Nature of Profit Distribution

In a capitalist system, profits don’t flow in a straight line. They tend to be lumpy. Payoffs usually come in irregular bursts, not in neat, predictable increments.

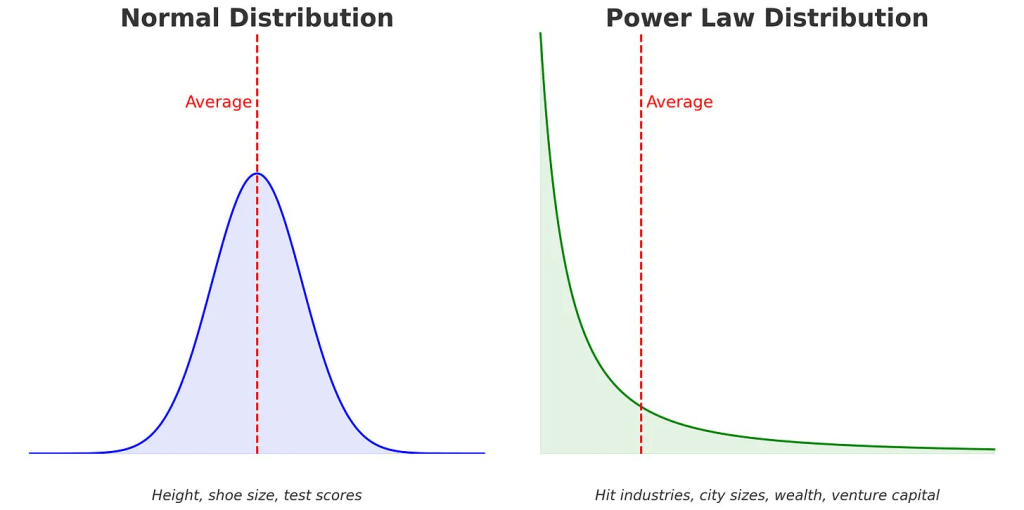

Profit distribution is a power law distribution.

That’s why entrepreneurs often go for years without much income. They’re building something, and if it works, the rewards come later—and often in huge multiples compared to what went in at the start. Venture capitalists understand this well, which is why they structure their portfolios to ride the power law: a few big winners more than make up for all the failures.

The challenge is that most of us aren’t used to thinking this way. Salaried workers get their pay on a fixed schedule, so it feels natural to expect income to arrive steadily. But businesses don’t earn this way. Corporate profits are uneven and irregular.

Unfortunately, it’s also uncomfortable because our expenses move in the opposite direction—they’re regular (think of loans, mortgages, utilities, insurance premiums). That creates a mismatch between how money comes in and how it goes out.

The key is to accept this reality and find a way to align to it. That might mean keeping more cash buffers, lowering fixed costs, or structuring your life so you can live with irregular income. Once you stop expecting smoothness, it becomes easier to see opportunities where others only see risk.

*

By working on creating value, patiently building and ‘fattening’ edges, and staying focused long enough to exploit it, the chase after the next shiny thing loses it’s lustre.

And when you align yourself with how wealth really accumulates—infrequent, lumpy, and often after long periods of waiting—you stop gambling on long odds. This way, you build wealth that endures, taking the quiet, patient road that leads to the greatest rewards.

Leave a comment