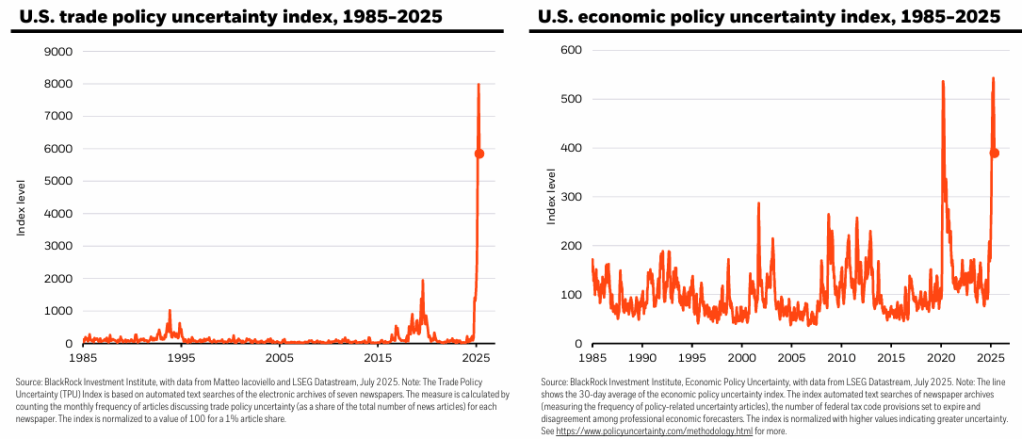

The word ‘uncertainty’ is always used at market outlooks and second half / third quarter outlook events this time round were no different. The chart below from BlackRock illustrates what most are feeling:

Slowing labour markets and U.S. President Trump’s trade wars are weighing on business and investor sentiment.

One speaker at a particular forum commented that this is the ‘most crazy period she has seen in all her career‘. She’s a senior portfolio manager at a venerable asset management house, and probably started her career in the early 1990s.

I don’t mean any form of disrespect. Her comments struck me not because of the truth of the claim (it’s certainly troubling times), but rather the use of that reference period – the period of her professional experience.

If she started her career in 1990, that would mean that her entire professional investment career since was exactly through one of the best periods for investors in financial market history. We had the end of the Cold War back then where geopolitical risks receded and globalization was at its peak. The emerging market boom of the 2000s also created prosperity for the developing world.

If this is all we have for a reference period, then perhaps today’s world is indeed the craziest. The American President shooting tariffs from the hip and conducting executive policy on X, military clashes on almost every continent, the rise of artificial intelligence and humanoids – 2025 does seem bizarre compared to the 1990s and 2000s.

It dawned on me that if a competent and highly-experienced professional like herself could comment as such, then probably many others would feel the same. Many of her peers would be cautious in managing capital in the markets, given a changing business, trade and economic backdrop. This speaks volumes about the appetite for risk-taking and general level of confidence investors have.

But is it really true that the current state of our world and the markets are ‘crazy’?

The Law of Non-Contradiction

Calling someting ‘crazy’ is not just describing the condition of the observed subject or development. It is also an admission that that subject or development is beyond comprehension.

Oxford Dictionary’s definition of crazy as an adjective is ‘stupid or not reasonable’. In markets, many investors tend to dismiss and call an event ‘crazy!’ when supposedly an unexpected development occurs. It can be the price of a stock that skyrockets for no apparent reason, and we’ll hear investors saying ‘nuts!’.

However, in scientific discovery, scientists always strive for coherency of worldviews. Many of them have made breakthroughs when studying natural phenomena. For example, the well-known Albert Einstein developed the theory of general relativity by pursuing coherency of worldview.

Disturbed by the inconsistency between Newtonian mechanics and Maxwell’s electromagnetism (Maxwell’s equations implied that the speed of light is constant regardless of the observer’s motion, contrasting against the Newtonian worldview that time and space were absolute), he sought a unified coherent worldview and was not content with ‘patchwork’ science.

Einstein approached physics philosophically, seeing conceptual clarity and internal logical consistency. He often thought to himself how the world would look like if he rode alongside a beam of light, or if the laws of physics are the same for all observers.

By striving for coherency, he rethought space and time as a single, malleable entity (spacetime), replacing Newton’s view of gravity as a force with the idea that mass curves spacetime and that curvature guides motion. This discovery resolved the contradictions between Newtonian theory and Maxwell’s electromagnetism, and explained the anomalous precession of Mercury’s orbit.

Einstein’s relativity also predicted the bending of light by gravity which was confirmed later. His work is a classic case of seeking philosophical coherence in scientific laws and letting dissonance between models drive deep questioning. By doing so, Einstein arrived at new foundational principles that transformed science.

Many other thinkers as Kurt Gödel and scientists such as Barbara McClintock and Lynn Margulis were brilliant examples of such a process that helped them pioneer new discoveries.

This is the Law of Non-Contradiction.

Financial markets may be different in the aspect of them being social phenomena, and are complex, adaptive systems. Market prices are the consequent net effect of participants’ actions (i.e. us in the system).

Despite that, applying the law of non-contradiction to markets, then calling something ‘crazy’ is actually indirectly admitting incoherency in one’s worldview. It’s often a sign of lazy reasoning. Many market participants are guilty of this if they’re honest with themselves.

However, if we’re curious about investigating, we could scratch beneath the surface of apparent contradictions to gain better insight or understanding of a system’s substructure that’s causing the observed development. We could then pick-up unidentified capital flow feedback loops that traditional models of analysis fall short of.

When I first heard of the Labubu toy and Pop Mart doll craze, I thought that it’s probably a silly fad for teenagers. I’ve never bothered about it.

The trend supposedly went wild after a K-pop star was seen with it. Since then, Pop Mart’s share price has surged by more than 600%. Perhaps my bias against a silly-looking doll worked against me and when I found out how viral it became across Asia and in the West, I dismissed it as a ‘crazy’ trend.

But markets are complex, adaptive systems. My bias and lack of understanding worked against me; I failed to understand this emerging trend of blindboxes and stuffed toys. When Labubus were carried with designer bags, it became a symbol of fun and status and the trend fed upon its own momentum, which boosted Pop Mart’s earnings growth and valuation expansion in a self-reinforcing cycle.

The ‘No Sense’ Algorithm

Adam Robinson once said:

When someone says, “It makes no sense that…” really what they’re saying is this: “I have a dozen logical reasons why gold should be going higher but it keeps going lower, therefore that makes no sense.” But really, what makes no sense is their model of the world, right? So I know when that happens, that there’s some other very powerful reason why gold keeps going lower that trumps all the “logical reasons.”

… Things that don’t make sense are an Algorithm for finding opportunities. Where do we find good ideas? Look where no one looks. When thing’s don’t make sense, get into the trade.

Robinson’s comments makes sense (no pun intended). Financial assets trade and price at the margin – prices change as buying and selling pressures fluctuate throughout market cycles. Some investors can do very well by simply sizing up participants’ positioning.

Look out for such languages and lazy reasoning the next time you’re in a conversation about markets.

Broaden Your Perspective, Seek Understanding & Coherency

We can try our utmost by broadening our perspectives, staying curious and investigate apparent contradictions to seek internal coherency across our worldview. Three main ways come to mind.

Stay Inquisitive, Embrace Intellectual Humility

It’s easy to dismiss something as silly just because it seems farfetched or difficult to understand. But judgment can always be suspended for a while while pursuing further investigation.

Generals have to deal with the fog of war on the battlefield. No matter how well-informed, your curernt perspective is still limited. Bearing this, there’s always things that have yet to be discovered, and it’s wise to be humble about our own knowledge and to stay curious. In fact, anything that piques your curiosity should be pursued, especially in financial markets.

Question your initial reactions when you form a quick judgment about something. Ask yourself: what assumptions did you have? What was the mental model used? What evidence did you have? Were you missing something in the process? How certain are you of your judgment?

Go Multidisciplinary; Reading Broadly From Diverse Sources

A historian may analyse a business challenge differently than an engineer or someone with a psychology background. An engineering research breakthrough could happen because of a close study of a biological system. An economist may design better models by adopting a neuroscience lens to appreciate the complexity of market behaviour.

Understanding and learning different methodologies equips you with more tools for any analytical task. In evolving market paradigms, this could translate into a competitive edge.

With the advancement of Artificial Intelligence (A.I.), it’s vital to be as multidisciplinary as possible to see across fields, gain unique insights and be creative. The Renaissance Man is back.

Also, study the past. Increase your sample size as much as possible. Is it really crazy that U.S. President Donald Trump is using tariffs as a policy tool? Has there been instances in the past where tariffs were wielded like so? Is it unusual that the U.S. and China are geopolitical rivals? Did the U.S. government ever default on its debt?

When researching, seek out diverse information sources to peel away the biases and lenses of variant perspectives. And it may be worthwhile to deliberately consider how an issue may look from the viewpoints of multiple stakeholders.

Systems Thinking

It isn’t taught widely, so most of us learn this by experience in the real world. But systems thinking is useful for the fine art of investing and speculation.

Systems thinking is a way of making sense of complexity by looking at the bigger picture and recognising patterns and relationships within a defined system. This contrasts with trying to focus on analysing isolated components and then piecing them together to reach a conclusion.

The markets can be considered a complex system, and asset prices may tend to be in self-reinforcing trends due to feedback loops (referencing the earlier example of Pop Mart). Investors in general may not behave the way regulators desire due to an unexpected emergent behaviour (emergent property) when they engineer policies without understanding the broader context and investor constrains.

Perhaps the somewhat ‘crazy’ political environment is an effect of the widening gulf between the have-nots and haves alongside a reversal in globalist sentiment? Will there be unintended consequences of the weaponisation of the U.S. Dollar?

*

There’s really no such thing as ‘no sense’ or ‘crazy’ even in the most seemingly-absurd situations in markets. The objective in investing is to make money and not impose what you think is ‘right’ or not onto the markets. Question what you really know and think is ‘crazy’ and who knows, a promising investment opportunity may appear.

Leave a comment